Asian liquefied natural gas (LNG) buyers are navigating a near-term market that is so finely balanced that any supply disruptions or demand upsides could cause significant price volatility according to Mangesh Dilip Patankar, vice president, APAC Gas and LNG Consulting at Wood Mackenzie.

Speaking on the sidelines of the Gastech 2023 conference being held in Singapore, Patanker said that the LNG market is at a critical juncture and the uncertain outlook has affected pricing and contract terms significantly and widened the gap between buyer and seller aspirations. ‘Many LNG buyers face the challenge of ensuring LNG supply security, while keeping their procurement costs competitive and contractual terms flexible,’ Patanker says. ‘Simultaneously, the terms in LNG SPAs [sale and purchase agreements] are also evolving as LNG trading increases.’

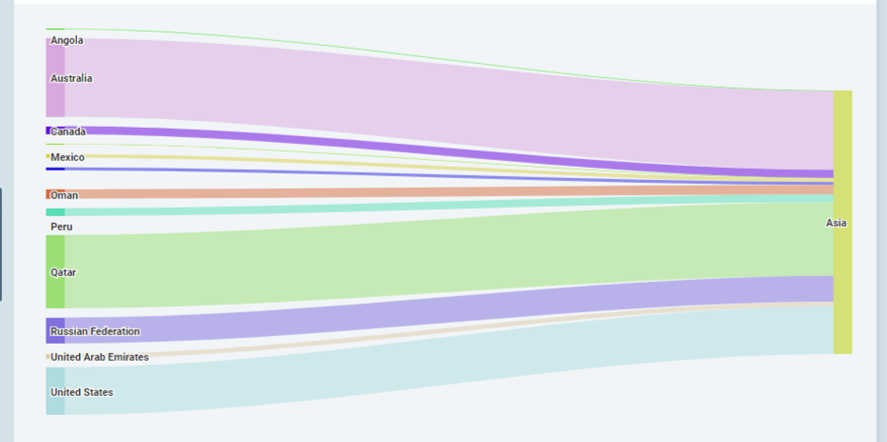

Source: Wood Mackenzie Lens

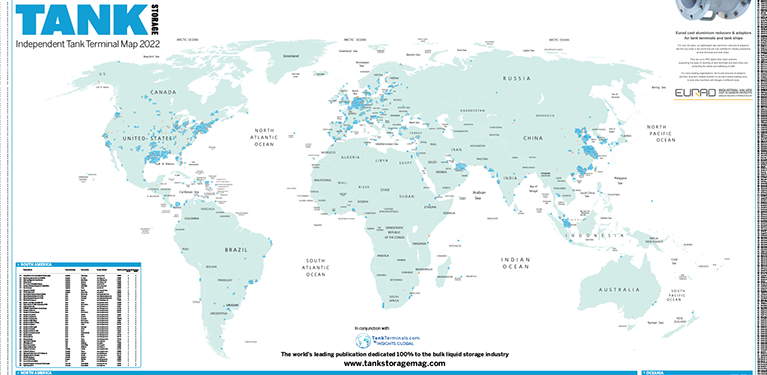

According to Wood Mackenzie Lens, Australia and Qatar will be biggest suppliers of LNG to Asia throughout 2023-2030 with volumes of over 886 million tonnes (MT) and 827 MT respectively. This will account for almost 60% of the total volumes of LNG delivered into Asia during this period.

Patanker believes that the LNG market cooling off from last year’s highs means emerging buyers, particularly in Asia, are now keen to reengage sellers. However, he warns that any Asian buyers looking to re-enter the market must understand LNG’s complex fundamentals and track its price volatility.

‘As [LNG] buyers contemplate their options, it becomes crucial for them to evaluate the mix of pricing indices in their portfolio such as oil or Henry Hub and whether they should also take some exposure to spot pricing/spot purchases,’ Patanker said.

Patanker added that with the new wave of LNG projects not expected to make a significant impact in terms of increased supply until 2026, the market looks set to remain tight. Wood Mackenzie LENS data shows LNG year-on-year supply growth averaging 40 million metric tonnes per annum (mmtpa) annually from 2026 to 2028, helping the global market to rebalance, which is predicted to bring prices down.

Patanker believes this will improve gas affordability, facilitate LNG availability for Europe and enable a rebound of demand in Asia. ‘The outlook for LNG market beyond 2028 is then dependent on the level of liquefaction project final investment decisions (FIDs) within the next 1-2 years as well as the pace of energy transition, in addition to several dynamic supply-demand related factors.’

Mangesh Dilip Patankar is attending Gastech 2023 between October 5-8. If you would like to speak to Mangesh and the Gas & LNG consultancy team, please click here to book a meeting or go to the Wood Mackenzie stand(D371) in the exhibition hall.

The Tank Storage Magazine team is also at Gastech – contact gary.kakoullis@easyfairs.com to set up a meeting!